For Australian Business Owners Who Are Tired of That Nagging "What If Something's Wrong?" Feeling:

Run This 30-Minute Safety Check. See What's Hiding in Your Books Before the ato does.

What the ATO would question...and what you can safely ignore.

🔒 100% Secure 256-Bit Security Encryption

The False Security Trap

You've done everything right.

You've got Xero or MYOB humming along in the background.

You've got a bookkeeper (or you're handling it yourself and doing a decent job, you think).

You lodge your BAS on time. You pay your bills. You're not some cowboy operator running things on vibes.

So why does that low-grade anxiety keep showing up?

That 2am thought: "What if there's something I don't know about?"

That slight dread before meeting with your accountant: "What are they going to find this time?"

That nagging feeling when an ATO letter arrives, even if it's just routine correspondence.

Here's what nobody tells you:

The anxiety isn't irrational. It's a signal.

"The ATO is focusing on contractors who fail to report all their income... key tax audit triggers that catch the ATO's attention."

Lawpath, Tax Audit Triggers 2025: Small Business Guide

Because right now, today, something is probably wrong in your books. Not because you're careless. But because your systems aren't designed to catch it.

Only a few days left

Get It For $27

YOU’RE SAVING $708+ TODAY

Get The Zero-Surprise ATO Safety Check Assistant for $27

Bonuses Will Be Delivered Instantly.

Get Full Access Right Away.

🔒100% Secure 256-Bit Security Encryption

WHAT THIS SAFETY CHECK HELPS YOU AVOID

The $1,650 Late Lodgement Penalty

The ATO imposes $330 per 28-day period for late lodgements, up to $1,650 for small businesses. The Safety Check identifies the process breakdowns that lead to missed deadlines — before they cost you.

"As of 7 November 2024, one penalty unit equals $330. The total penalty depends on your business size and how late or overdue your lodgement is." - Sleek.com, ATO Tax Penalties 2025

The 11.34% Non-Deductible Interest Charge

From July 1, 2025, the General Interest Charge will no longer be tax-deductible for most businesses. Every dollar of tax debt will cost you more than ever. The Safety Check finds the errors that lead to shortfalls — before they compound.

"The general interest charge (GIC – currently 11.34%) will lose tax deductibility status on July 1, 2025." - Austwise, ATO Changes 2025

The $4,750 Average Audit Cost

A simple ATO query can cost thousands in professional fees before any penalties or back-taxes. The Safety Check helps you fix the red flags that trigger audits in the first place.

"The ATO requested three years' worth of records, resulting in a lengthy process and $4,750 in professional fees." - AuditCover, Tax Audit Insurance for Small Businesses

The $27.2 Billion Tax Gap

The ATO estimates the small business tax gap at $27.2 billion, and they're actively targeting the common errors that contribute to it. GST miscodings. Over-claimed deductions. Super shortfalls.

The question isn't whether they're looking. It's whether they're looking at you.

"The ATO's small business focus comes after data revealed unpaid tax debts grew to $35.6 billion in 2024." - Beweiszer, ATO Small Business Hit List 2024

🔒 100% Secure 256-Bit Security Encryption

THE FOUR HIDDEN COSTS OF

"HOPING EVERYTHING'S FINE"

Most business owners don't realize they're paying a tax every single week, even when nothing's actually wrong.

1) The Mental Tax

That constant background hum of uncertainty. The "what ifs" that steal your focus. The way you slightly tense up whenever finances come up in conversation.

This costs you more than you think — in decision quality, in sleep, in the energy you could be putting into growth.

2) The Cleanup Tax

When errors finally surface (and they always do), you're not just fixing the error. You're paying your accountant $200-$350/hour to untangle three months of compounded mistakes.

A $50 miscoding this week becomes a $800 accounting bill in December.

3) The Compounding Cost

That duplicate payment sitting in your books right now? It's not $500. It's $500 plus three months of incorrect reporting, plus the reconciliation nightmare, plus the supplier relationship damage when you ask for it back.

Small errors don't stay small. They breed.

4) The Personal Liability Risk

Director Penalty Notices don't send warnings. By the time the ATO tells you there's a Superannuation shortfall, your personal assets are already on the line

Your house. Your car. Your savings.

Not the company's problem. Yours.

"A Director Penalty Notice (DPN) is issued by the Australian Taxation Office (ATO) to make a company director personally liable for unpaid tax debts."

OBP, The Personal Impact of Director Penalty Notices

"The ATO's 2025 focus areas for small businesses include income omission, GST reporting, and non-commercial losses. They highlight rules and red flags."

Wolters Kluwer, Expert Insights on ATO Focus Areas 2025

And the worst part?

Most of these issues don’t show up where you expect them to.

WHY YOUR CURRENT SETUP ISN'T PROTECTING YOU

Let's get honest about something:

Xero and MYOB don't audit your books...

They store data.

Bank feeds are convenient. They automatically pull transactions into your system. But they don't tell you if those transactions are

Coded correctly for GST

Duplicates bleeding cash every month

Creating a Super shortfall that's inching toward DPN territory

Going to trigger an ATO query six months from now

Your software is a filing cabinet. It doesn't ask questions.

Your bookkeeper isn't running diagnostics.

They're reconciling. They're entering data. They're making sure the numbers match.

They're not asking:

"Is this business at risk for Director Penalty Notices?"

"Are there patterns indicating duplicate payments?"

"Where would the ATO look first if they audited this file?"

That's not their job. And even if it was...they're only looking at the data you give them.

Your accountant sees your books quarterly.

That's 90 days for small errors to compound into expensive disasters.

💥90 days of duplicate payments draining cash

💥90 days of GST miscodings building into a nasty BAS amendment.

💥90 days of Super shortfalls creeping toward personal liability

The fundamental problem isn't your team. It's the gap.

Nobody's checking what's happening between quarterly reviews.

Introducing The Zero-Surprise ATO Safety Check Assistant

Think of it this way:

Your accountant is the specialist you see once a year for the full workup.

Your bookkeeper records your vitals, doing data entry.

This Safety Check is the 30-minute diagnostic that tells you what to watch before your next appointment.

It doesn't replace your team. It fills the gap your team can't cover.

"AI is transforming tax compliance, evolving from concept to reality, demanding flexibility and mindset shift for long-term value."

EY, AI and the transformation of tax compliance

Most business owners assume problems show up as obvious errors.

They don’t.

They hide in patterns — timing gaps, review frequency, responsibility gaps.

That’s what this check looks for.

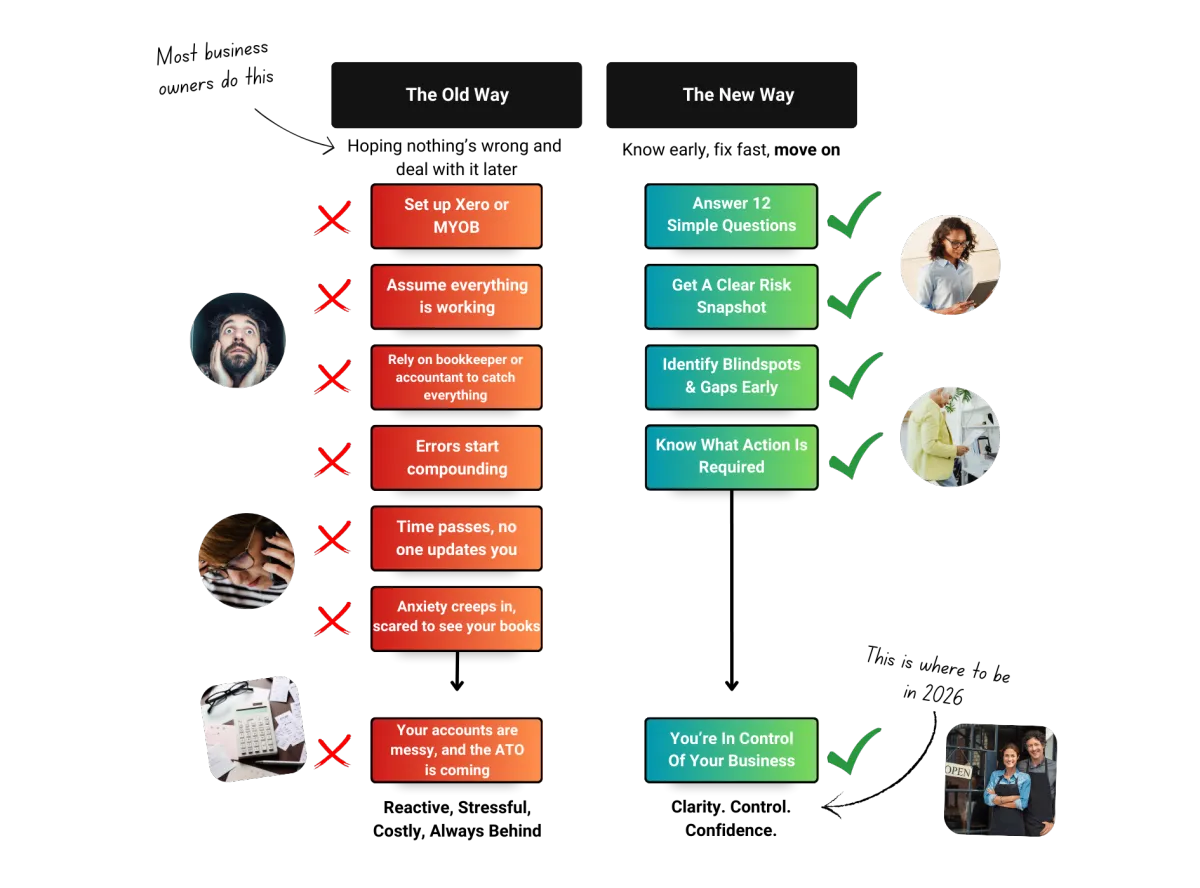

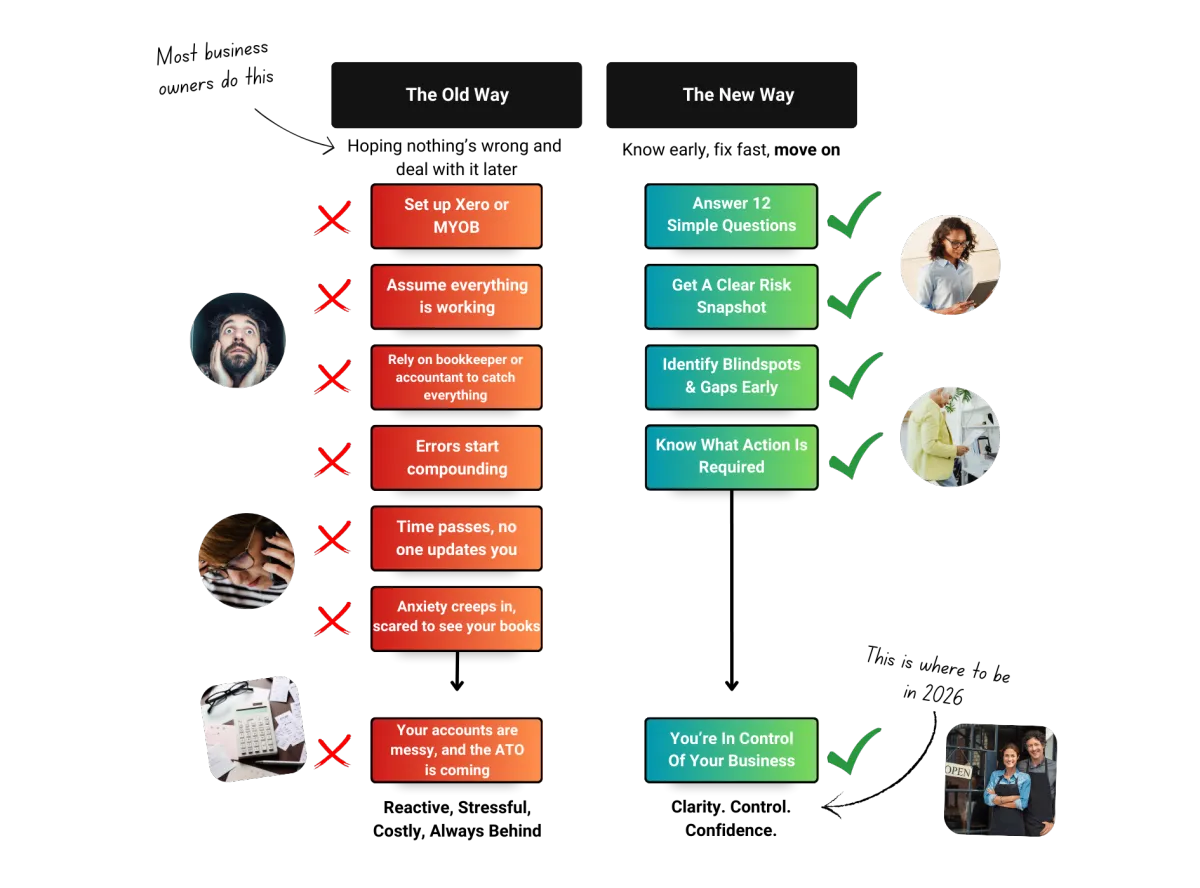

HOW IT WORKS

Step 1: Answer 12 Simple Questions (15 minutes)

The AI asks you easy, conversational questions:

• Do you lodge BAS monthly or quarterly?

• Who checks your books, and how often?

• When was your last proper financial review?

• Are you a listed director of the business?

• What accounting software do you use?

• Any duplicate payments or strange transactions lately?

No jargon. No complexity. Just plain questions about how your business actually runs.

Step 2: Get Your Personalized Admin Blind Spot Report (Instant)

Based on your answers, the AI generates a custom 6-section report:

📊 Your Risk Snapshot

A clear overview of your current compliance posture — what's solid, what's shaky, what's missing.

⚠️ Your Blind Spot Zones

Specific areas where errors are most likely hiding based on your setup, software, and review frequency.

💰 Your Cost of Delay

What these issues could cost if they're not addressed in the next 30-90 days.

🎯 Your Personal Exposure Level

Whether you're at risk for Director Penalty Notices based on your Super/GST patterns.

✅ Fix Now / 👀 Watch Later List

Prioritised action items: what to check this week vs. what to monitor monthly.

🔁 Your Ongoing Safety Plan

A simple rhythm to stay on top of things - whether you want a DIY checklist or automated monitoring.

Step 3: Take Action (Or Don't — You Decide)

Based on your answers, the AI generates a custom 6-section report:

Here's what makes this different from a checklist:

This report is built for YOUR business.

Not "here's what all businesses should do."

But: "Based on your quarterly BAS lodgement, your use of Xero, and the fact that your bookkeeper only reconciles monthly — here are the three specific areas where errors are most likely sitting undetected right now."

You get actionable clarity. Not overwhelming information.

Only a few days left

Now For ONLY $27.00

Get The Zero-Surprise ATO Safety Check Assistant for $27

Bonuses Will Be Delivered Instantly. Get Full Access Right Away.

100% Secure 256-Bit Security Encryption

THE 30-MINUTE DIAGNOSTIC THAT CHANGES EVERYTHING

What if you could sit down right now — for less than 30 minutes — and walk away knowing:

What's Actually Fine (so you can stop wasting mental energy worrying about it)

What Needs a Second Look (specific areas to check or ask your bookkeeper about)

What's High-Risk (compliance gaps that could trigger ATO attention or personal liability)

Your Fix Now vs. Watch List (prioritized by urgency and actual cost)

Your Ongoing Safety Rhythm (how to stay on top of this going forward — without adding admin)

No connecting your Xero account.

No sharing your financial data.

No trusting a stranger with access to your books.

Just 12 straightforward questions about how your business actually operates — and a clear, plain-English report showing exactly where to look.

🔒 100% Secure 256-Bit Security Encryption

THE REAL OUTCOME: PEACE OF MIND WITHOUT THE PANIC

Here's what actually happens when you complete the Safety Check:

Scenario 1: The Relief of "All Clear"

"I was convinced something was wrong. Turns out my setup is actually solid! I just needed to add one monthly spot-check for duplicates. Now I can stop lying awake wondering if something's about to blow up."

Value: Eliminated the anxiety that was costing mental bandwidth every single day.

The emotional shift: Finally sleep through the night without that 2am "what if" thought.

Scenario 2: The $6,200 Disaster Caught Early

"The report flagged that my bookkeeper wasn't verifying Super calculations monthly. I asked them to check... and turns out we'd been underpaying for 4 months. Fixed it immediately. If the ATO had found it first? Director Penalty Notice. My house on the line."

Value: Caught a personal liability issue before it became a nightmare.

The emotional shift: The weight off my shoulders knowing my house isn't on the line anymore.

Scenario 3: The "Cleanup Tax" Eliminated

"Found out I'd been paying the same supplier twice for three months. $2,400 gone. The report showed me exactly where to look. Got it reversed the same week."

Value: $2,400 recovered + avoided paying the accountant $600 to find it later.

The emotional shift: Felt like a smart operator who catches problems, not a disorganized owner who gets caught.

Scenario 4: The Confidence to Actually Grow

"I've been hesitant to hire because I didn't trust my financial systems. The Safety Check showed me the two areas that needed tightening. Now I have a clear plan and can focus on growth instead of worrying about admin disasters."

Value: Removed the psychological barrier that was keeping the business stuck.

The emotional shift: Finally focusing on growth instead of constantly looking over my shoulder.

The common thread?

They just knew what to look for.

WHY $27? (AND NOT FREE)

You might be wondering why this isn't a free tool.

And it's for this very reason:

Free tools don't get used.

They get bookmarked. Downloaded. Saved for "later."

And "later" never comes... until the ATO letter arrives.

The business owners who invest $27 are the ones who actually complete the Safety Check. They forward the report to their bookkeeper. They fix the issues. They implement the rhythm.

$27 filters for action-takers.

That's you.

At this point, there are only two reasonable options.

Option 1: Spend 30 minutes this week finding out what’s actually going on.

Option 2: Keep operating blind and hope nothing expensive surfaces later.

Most people choose option 2 by default.

Not because it’s smarter but because it’s easier to delay.

Here's EVERYTHING You Get For $27

Order This Today

And You'll Also Get:

Bonus #1

Bookkeeper/Accountant Forwarding Kit

($47 Value)

Pre-written email templates so you can delegate without awkward conversations, including

Issue escalation email (for bookkeeper)

Quarterly review prep email (for accountant)

"Am I missing something?" verification template

Stop trying to explain financial concepts you barely understand. Just forward the report.

Bonus #2

The Director's Shield Checklist

($97 Value)

Personal liability protection guide covering:

Director Penalty Notice triggers (Super/PAYG)

When YOU'RE personally at risk vs. business-only risk

Early warning signs before ATO escalation

Emergency response if you get "the letter"

Because your house shouldn't be collateral for an admin error.

Total Real-World Value: $735

Normal Price: $197

TODAY'S SPECIAL PRICE:

$27.00

You Save: $708.00

100% Secure 256-Bit Security Encryption

THE PATTERN THAT KEEPS REPEATING

This is the pattern I see repeated too often (including myself before creating this tool):

Every Australian SME owner I spoke with had the same gap:

They had the software. They had the bookkeeper. They were "doing everything right."

But nobody was running diagnostic checks between quarterly reviews.

It's like having smoke detectors installed but never testing the batteries.

The system exists. But there's no one checking if the system is actually working.

So errors sit there:

→ Duplicate payments draining $500-$5,000 unnoticed

→ GST miscodings creating hidden liabilities

→ Super shortfalls creeping toward DPN territory

→ Reconciliation issues that won't surface until EOFY

Not because business owners are careless.

Because they don't know what to check for

WHAT MAKES THIS DIFFERENT FROM CHECKLISTS

Most resources give you:

❌ "Make sure you reconcile your accounts regularly"

❌ "Review your GST coding"

❌ "Keep good records"

❌ "Work with a qualified bookkeeper"

Translation: Vague advice that doesn't tell you what's actually wrong right now.

The Safety Check gives you:

✅ "Based on your quarterly BAS lodgement and monthly bookkeeper reconciliation, errors are sitting undetected for 60-75 days on average. Here are the three areas where issues are most likely compounding right now."

✅ "Your bookkeeper is doing data entry and reconciliation, but nobody's checking for duplicate payments. Run this specific Xero report weekly to catch them."

✅ "You're a listed director with 8 employees. Your Super compliance risk is elevated if calculations aren't verified monthly. Here's the question to ask your bookkeeper."

✅ "Your GST setup is actually solid — stop worrying about that. Focus your energy on these two higher-risk areas instead."

One is information. The other is a diagnosis built for your business.

My 'Clarity Or Refund' Promise :

Here's my promise:

Complete the Zero-Surprise ATO Safety Check. Get your personalized report.

If it doesn't give you at least one specific, actionable insight about where to look or what to check in your business...

Email [email protected] within 7 days. I'll refund your $27. No questions. No hassle.

This means I'm taking ALL the risk here. The only way you can lose is by not trying this today.

No questions asked. No hard feelings.

The Cost of Waiting

Look, I get it.

$27 is nothing. You'll spend more than that on lunch tomorrow.

So the temptation is to think: "I'll do this later when things calm down."

But here's the thing:

Every week you wait is another week errors are sitting in your books undetected.

That duplicate payment from last month? Still draining cash.

That GST miscoding from six weeks ago? Growing into a bigger discrepancy.

That Super shortfall you don't know about? Moving closer to DPN territory.

You don't know what's wrong right now.

But something probably is.

And the difference between finding it this week vs. finding it next quarter is literally thousands of dollars in cleanup costs, penalties, and stress.

Consider this: The average cost of responding to a simple ATO audit is $4,750 in professional fees alone — before any penalties or back-taxes. The Safety Check costs $27 and takes 30 minutes.

The math is obvious.

The 30-Minute Question:

"Can I afford half an hour this week to find out what I don't know?"

Because that's all this takes.

30 minutes to answer 12 questions. 30 minutes to get a clear report. 30 minutes to eliminate the "what if" that's been following you around.

vs.

Another 90 days of operating blind. Another 90 days of errors compounding. Another 90 days of hoping your accountant doesn't find something expensive.

The cost of NOT knowing is always higher than $27.

Here’s What

to Do Next

Step 1: Notice how easily you can click the Green button below

Step 2: Feel confident as you fill in your name, email and payment details

Step 3: Get excited as you gain instant access to the Zero-Surprise ATO Safety Check Assistant

100% Secure 256-Bit Security Encryption

Only a few days left

YOU’RE SAVING $708+ TODAY

Get The Zero-Surprise ATO Safety Check Assistant for $27

Bonuses Will Be Delivered Instantly. Get Full Access Right Away.

100% Secure 256-Bit Security Encryption

Frequently Asked Questions

Q: Who is this for?

A: For Australian small-to-medium business owners who do their own books (or work with a part-time bookkeeper) and want to catch compliance issues before the ATO does - or before their accountant hits them with a massive bill to fix everything at year-end. If you've got that nagging worry that something's not quite right in your records, this gives you peace of mind .

Q: Is this just a generic checklist?

A: No. This is a personalized diagnostic.

Generic checklists tell you "here's what all businesses should do."

The Safety Check tells you: "Based on YOUR software, YOUR review frequency, and YOUR team structure — here are the specific blind spots in YOUR business."

It's the difference between WebMD and an actual doctor.

Q: Do I need to connect my Xero/MYOB account?

A: Absolutely not.

You don't connect any accounts. You don't share any financial data. You don't give access to anything.

You answer 12 simple questions about how your business operates — and the AI generates your report based on your answers.

Your financial data stays private. Always.

Q: My accountant already handles this.

Your accountant sees your books quarterly, sometimes just once a year at tax time.

That's 90-365 days for errors to compound undetected. Your accountant isn't running weekly diagnostics. They're not checking for duplicate payments between visits. They're reacting to what they find, not proactively catching issues.

The Safety Check fills the gap between accountant visits. It doesn't replace them — it makes their job easier (and your bill smaller).

Q: How accurate is the AI? Can I trust it?

The AI is trained on ATO guidelines, common compliance patterns, and real-world error data from Australian SMEs.

But let's be clear: this isn't a replacement for professional accounting advice. It's a diagnostic tool that flags potential issues for you to verify.

Think of it like a smoke detector. It tells you something might be wrong so you can investigate. It doesn't replace the fire department, but it gives you early warning before small issues become disasters.

The business owners who get value from this use it as a starting point, then verify flagged issues with their bookkeeper or accountant.

Q: What if I don't understand the report?

Every section includes:

- Plain-English explanations (no jargon)

- "Why this matters" context

- "How to fix this" instructions

- "Who to ask" guidance

Plus, you get the Bookkeeper/Accountant Forwarding Kit — so you can simply send the relevant sections to your team and let them handle it.

Q: How long does this take?

About 30 minutes total:

- 15 minutes to answer the questions

- Instant report generation

- 10-15 minutes to review your results

Less time than you'd spend on hold waiting for your accountant to call back.

Q: What if the report doesn't find any issues?

Then you get something even more valuable: peace of mind.

You'll know your setup is solid, which areas you can stop worrying about, and what simple rhythm will keep things clean going forward.

Eliminating false anxiety is worth $27 by itself.

Q: Can I run this multiple times?

Yes. Once you purchase, you can run the Safety Check whenever you want.

- Run it now for your baseline

- Run it again in 3 months to verify improvements

- Run it before meeting with your accountant to prep

- Run it whenever you change bookkeepers or systems

It's yours. Use it however you need.

Q: What if I have multiple businesses?

You can run a separate Safety Check for each one. Each business gets its own personalized report based on its specific setup.

100% Secure 256-Bit Security Encryption

P.S. This is a one-time $27 payment. No subscriptions. No recurring charges.

Just a complete diagnostic you can use as many times as you want, for as many businesses as you have. If you're going to spend $27 on something this week anyway -make it something that could save you thousands.

Copyright © 2026| Aquila Technologies Pty Ltd | All Rights Reserved

NOT FACEBOOK™: This site is not a part of the Facebook™ website or Facebook Inc. Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc.

This AI-powered audit is an educational tool that highlights potential compliance gaps in your bookkeeping records. It is NOT financial advice, tax advice, or a substitute for professional accounting services. While our AI is trained on ATO guidelines and common compliance issues, it cannot replace a qualified accountant or tax professional. You remain responsible for the accuracy of your financial records and should consult a registered tax agent or accountant for specific advice about your business. Any issues identified are for informational purposes only.